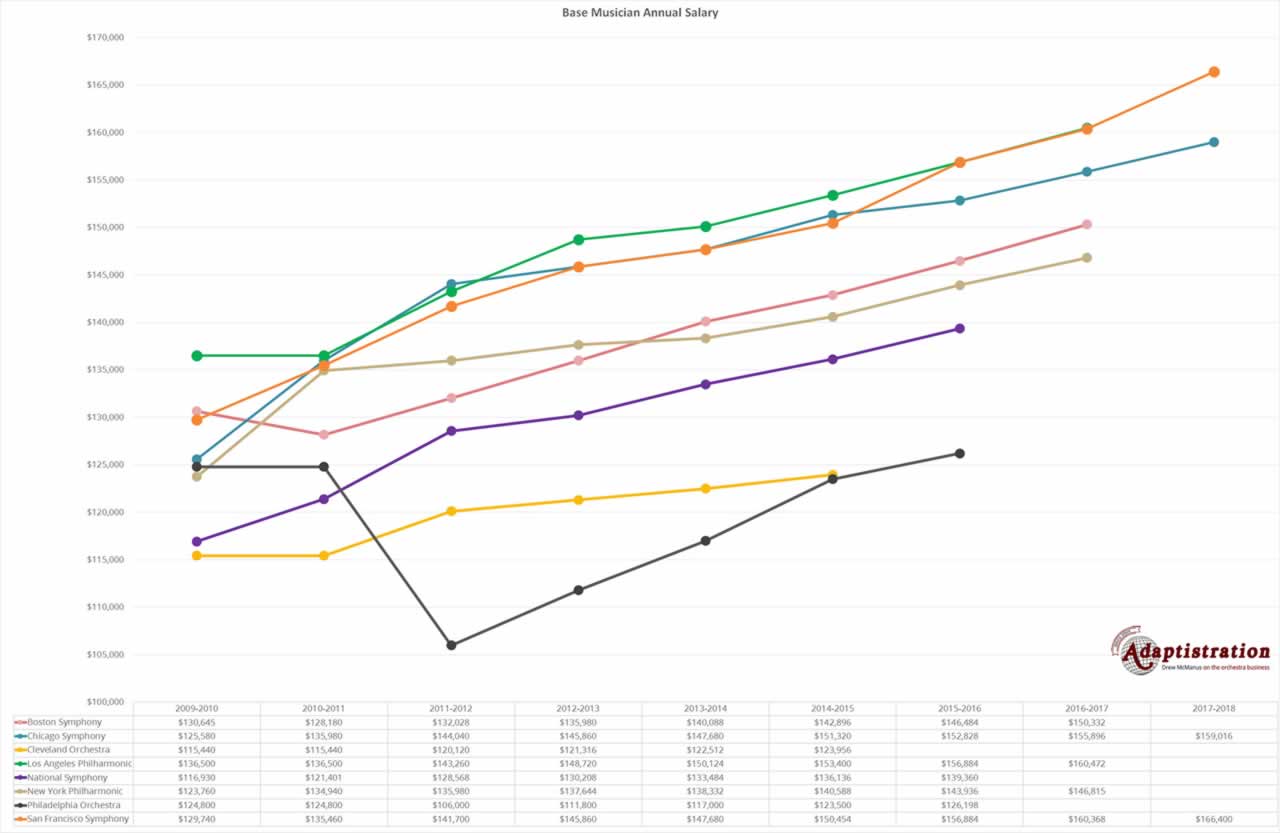

Imagine John Smith: By the way, it’s September 1st, 2001. In a few weeks, the stock market is going to do it’s impersonation of Greg Louganis and Mr. Smith is going to discover that perhaps he should have paid closer attention to that Ant and the Grasshopper parable. What if Mr. Smith was your accountant? Would you take his advice if he recommended that you to live a lifestyle comparable his? Well for the past 15 years orchestras have managed their money much like our fictional Mr. Smith. Do you think the problem isn’t industry wide and restricted to a few rogue orchestras? Well here are some quotes from Henry Fogel, former President of the Chicago Symphony and current President & CEO of the

” Noting that a previous CFO had inappropriately written off various items, so as to make the financial picture appear better than it was, Fogel said: We [Chicago] spent too much when economic times were terrific during the great economy of the 1990’s orchestras perhaps expanded faster than they should have. I believe that in really good economic times orchestras should not spend up to their revenues and should instead go for a surplus and keep a cushion for the future. I wish I’d believed that 10 or 15 years ago.”

The sobering result from all of this is that orchestras were unprepared for the resulting financial meltdown. Many orchestra boards and administrations have implemented knee-jerk reactions that at best retard their artistic growth for nearly a decade and at worst merely postpone their demise by a few years.

Of course we can all look back with 20/20 hindsight and say this was a ridiculous way to manage the business of an orchestra. But this situation goes a long way toward allowing us inside the mindset of how many managers plan their budgets. Has every orchestra been guilty of following these questionable business practices? Fortunately, no. The problem is that most orchestras are guilty, but it is not always due to a lack of capable leadership, rather a lack of proper oversight. Currently, most orchestra administrations are responsible only to their respective boards, who perhaps run an audit every few years. These audits are frequently conducted by an accounting firm that has business connections to a board member, thus creating a conflict of interest. What the industry needs is a strict universal annual auditing process by a third party with the purpose to find any hint of suspicious budgeting practices. The positive results will come directly from the audit itself in addition to compelling boards and management to take their responsibilities seriously.

This should become a flexible system that is not designed as punishment for bad behavior, but incentive to manage an orchestra’s growth through all economic climates. It should spawn creativity and responsibility among all levels of management. The system should be able to detect the dubious tactics like those of the previous Chicago Symphony CFO described by Mr. Fogel. By removing the opportunity to do the “wrong thing” I believe we’ll see a much higher level of administrative ethics among current orchestra leaders and an even higher standard from our future leaders.